Blockchain 101

Basics

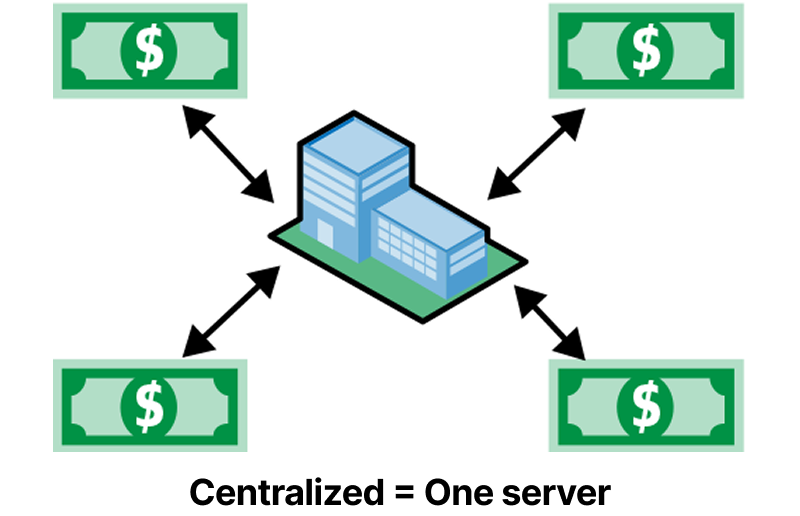

Section titled "Basics"Imagine you want to send $10 to your friend online. Using the current financial offerings you’d most likely need a trusted intermediary you both trust like a bank or a payment provider (e.g. PayPal or Stripe, for instance) to make sure the transaction works. But what if we didn’t need to rely on any intermediary banks or central authority?

Today, when you give someone a $10 bill, you no longer have that bill (bye cash money 💸), so it’s impossible to spend it twice. With digital money, it’s all just computer code. But without a bank watching, how do you prevent someone from copying their digital $10 and spending it multiple times? Well, this is what’s called the “double-spending problem.”

Early attempts at digital cash tried to solve this, but they all failed because they still needed some trusted central authority to prevent cheating. In 2008 Satoshi Nakamoto proposed a a novel solution: let everyone be the referee.

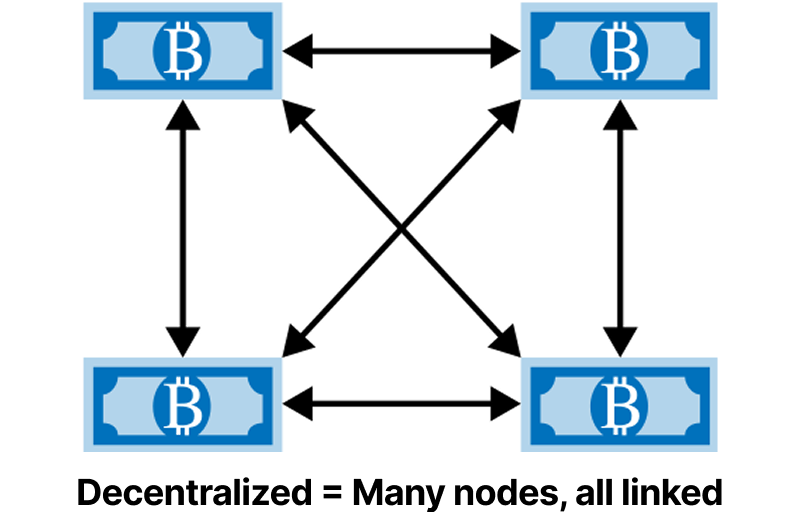

Thousands of computers keep identical copies of a public ledger and add new transactions only after independently checking that the spender has the funds available to spend. All the computers connected together in a network would need to agree on every new transaction such that fake or duplicate transactions get rejected.

Think of a ledger as a record book tracking who has what money. Instead of one bank keeping the official record, thousands of computers from around the world each keep identical copies. If someone tries to cheat, everyone will be able to tell and will reject the fake transaction.

This might sounds a little hard to believe, but really it’s kind of having everyone in a town keep a copy of everyone else’s transaction records. Satoshi figured out how to make this work using some clever math and computer science, and using that clever math and computer science is what brought blockchain technology into existence.

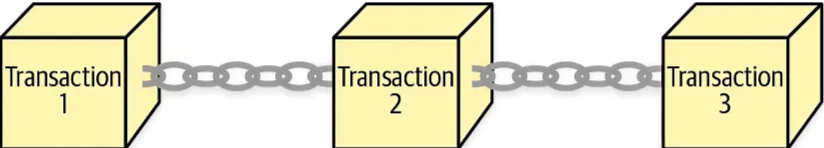

Now here is where it gets clever: transactions aren’t just recorded randomly. They’re bundled into blocks, and each new block references the previous block, creating an ‘unbreakable’ chain. Picture a diary where each page has with a small phrase that summarizes the content of that page. The next page begins by using the summarized small phrase to continue where it left off; if a third party changes page 50, the summary on page 51 no longer matches, so the forgery is obvious, and every later page would also break.

This chain structure makes the transaction history tamper-proof. To change one old transaction, you’d have to rewrite every block that came after it, which is practically impossible when thousands of computers are working in consensus.

This is the crux of blockchain technology also know as “distributed ledger technology” that allows for decentralized trust and consensus. Part of what made Bitcoin and Blockchains in-general so innovative, are the rewards and incentives that encourage honest participation in the blockchain and heavily punish dishonest and/or malicious behaviour. In general it’s just more profitable to act honestly on the blockchain.

What is Distributed Blockchain Technology?

Section titled "What is Distributed Blockchain Technology?"Now that we understand why blockchain technology was invented, let’s define what it actually is.

A distributed blockchain is defined as any technology where data is:

-

Shared across a network to create a public ledger of verified transactions

-

Linked using cryptography to maintain integrity

-

Distributed among network participants in an automated fashion

-

Composed of publicly available source code

What are Digital Assets?

Section titled "What are Digital Assets?"Digital Assets are simply any digital representation of value that gets recorded on this distributed ledger. So when we say someone “owns” a digital asset, we mean there is consensus amongst all participants of the network that they own the asset.

Think of blockchain as a global, tamper-proof filing cabinet that everyone can see but no one can secretly alter. Every “file” (transaction) gets stamped with proof of when it happened and what came before it.

The most popular types of blockchains are generally cryptocurrencies, and in fact Bitcoin popularized the concept of a blockchain, however, blockchains are NOT cryptocurrencies, it’s more like cryptocurrencies utilize blockchain technology in building their digital assets.

All blockchains are distributed ledgers, that’s it. It’s like electricity for the digital age. You can use electricity to power your home, a blender, a car, your router, your phone, etc… But one wouldn’t say electricity is the internet, it’s a similar relationship to how blockchain is to cryptocurrency.

Learn More: